THE MARKET STAGES

“Bull market born in Pessimism grow on skepticism and die on optimism ‘’

To time the market for precise entry and exact exit is always a hard job for the

traders and investors. If all traders and investors knew that skill then they exited the

2008 bear market, and have reentered in the 1st quarter of 2009. Here we present

what market stages are all about, and how to profit from them.

THE SIX STAGES

The market or stock consists of 6 stages which are cyclical in nature.

These are

1. The recovery stage

2. The accumulation stage

3. The bull stage

4. The warning stage

5. The distribution stage

6. The bear stage.

|

explanation of market stages through the use of 200ema, 50ema which we use more frequently for identification of market stages.

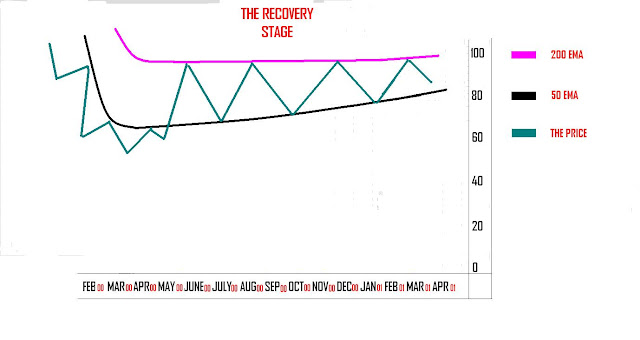

1. THE RECOVERY STAGE.

The recovery stage is full of volatile in nature. The price movement is random. We must use RSI or Stochastic in combination with EMA for entry and exit. Mostly the price of stock is in between the 200 EMA and 50EMA. Frequently the stock price gets support from 50Ema zone and resistance from 200 EMA zone.

Common chart patterns.

The popular patterns for this stage is Reverse Head and shoulders, Double or Treble bottom, valley like formations,Bump and reversal bottoms, cub with handle, Extended V bottom, Inverted roof, diamond bottom and the rectangle bottoms. These above patterns are all reversal patterns.

How to trade

Day traders, swing traders and short term traders can enter bu=y position at the support zone of 50 EMA and exit at the 200 EMA resistance zone. Stop loss level should be tight. Investors and long term traders may take buy position at the support of 50 EMA zone and hold it till the next stage develops.

2. THE ACCUMULATION STAGE

The 2nd stage after the recovery stage is accumulation stage. Here the recovery stage’s huge volatility is reduced by long-term traders and investors. The stock price crosses the 200 EMA resistances thereby giving the short sellers a huge loss. Then the resistance of 200 EMA zone turns into support zone. Duration of this stage is very short. Once the bottom volatility is over large bull trader and investors will enter into the market.

How to trade

Traders can enter buy position at the support zone of 200 EMA and hold it till the next stage develops. The investors who entered in previous stage may add position at the break up of 200 EMA resistance zone.

3. THE BULL STAGE

Accumulation stage is followed by the bull stage. The bull stage is the most important of all stages to every kind of traders and investors. For traders it is very easy to make money in this stage.

There is no volatility, upward trend is clear, visible and it is with in the trend lines and channels. Now the stock price is above the 50 EMA backed by the 200 EMA. The stock price gets the support of 50 EMA at regular intervals.

Common chart patterns

Ascending triangles, up channels, falling wedge, flags, high and tight flags, symmetrical triangles, running triangles and up trend lines are the usual patterns that we can see them in this stage.

How to trade

Swing and short term traders can take buy position at the support zone of 50 EMA. After the up trend of price from 50 EMA support, the day traders may enter at the support of 10 EMA. The stop loss level for this stage should be wide.Fresh investor may take position at the support of 50 EMA. Investors who positioned in previous stages may add position at every correction.

4 THE WARNING STAGE

Broken trend lines, broken channels, and increased volatility from trendy bull stage are the characters of warning stage. The stock price is in between the 50 EMA and 200 EMA. The 200 EMA and 50 EMA act like the support and resistance zones. Use of RSI and stochastic oscillator in combination of EMA is necessary for entry and exit of positions.

Common chart patterns

Rectangle top, diamond top, rooflike pattern, inverted cub and handle, double and triple top, head and shoulders and bump and reversal top are the common chart patterns found in the warning stage.

How to trade

Traders can go short position at the resistance of 50 EMA and cover their position in the support of 200 EMA. Stop loss level should be tight.Fresh investors should not take position in this stage. All the investors who takes buy position in previous stages should exit at the resistance of 50 EMA zone.

5 THE DISTRIBUTION STAGE

The volatility of warning stage is decreased substantially by the actions of traders and investors. The stock price breaks down the 200 EMA support zone. Then the 200 EMA support zone turns into resistance zone.

Duration of this stage is short. Decreased top volatility attracts bear side trader and investors profit booking.

How to trade

Traders can take short position at the resistance zone of 200 EMA and cover their position at the end of the swing. Investors should stay away from the market. Those who did not exit in the warning stage must exit in this stage.

6 THE BEAR STAGE

The bear stage has the clear down trend of price. Mostly the price is backed by trend lines and channels with no volatility. The stock price is below the 50 EMA then by 200 EMA. Frequent resistance of 50 EMA puts the price to free fall.

Common chart pattern

The usual patterns are descending triangles, down channels, rising wedges, flag, and down trend lines.

How to trade

Short term traders, swing traders can take short position at the resistance zone of 50 EMA. After the downswing of price from 50 EMA resistances the day traders may enter at the resistance of 10 EMA. Wide stop loss level should be applied. Investors should remain stay away from market.

The six stages which are elaborated above can be applied to all time frames across the markets including commodities, and Forex.Before initiating a trade or an investment traders and investors must find the stage in which the market is trading. For that question this article can be useful.

The author MAHENDRAVARMAN.MA, is one among the technical analysts, and the head of the risk management team in traderangers.com. As a trader and technical analyst, he has wide experience in Forex market and Indian stock market.

No comments:

Post a Comment